Uncovering the Hidden Gems: A Comprehensive Review of the Nifty Large Midcap Index

Exploring the Potential of the Nifty Large Midcap Index as a Diversified Investment Option

The Indian stock market has been on a rollercoaster ride in the past few years, and investors are looking for ways to navigate the volatile market while maximizing their returns. One index that has caught the attention of many investors is the Nifty Large Midcap Index. This index comprises 250 companies that are a mix of large and midcap companies, making it an attractive investment option for investors seeking exposure to both segments. In this comprehensive review, we will take a deep dive into the Nifty Large Midcap Index, exploring its performance over the years, its constituents, and its potential as a long-term investment option. Join us as we uncover the hidden gems of the Nifty Large Midcap Index.

What is Nifty Large Midcap Index ?

The Nifty Large Midcap 250 Index is a popular benchmark for investors looking to track the performance of India's large and mid-sized companies. The index includes 250 stocks listed on the National Stock Exchange of India (NSE) and is designed to represent 100% of the total market capitalization of the Nifty Large Midcap universe.

How is it different than NIFTY 100 and NIFTY MIDCAP 150 ?

As of April 2023, the top five sectors represented in the index are financial services (29.95%), energy (13.24%), information technology (12.52%), consumer goods (11.11%), and industrials (10.64%). The top five stocks in the index, based on weightage, are Reliance Industries Ltd. (5.10%), Kotak Mahindra Bank Ltd. (3.92%), ITC Ltd. (3.61%), Larsen & Toubro Ltd. (2.85%), and Infosys Ltd. (2.43%).

This means that it’s like a perfect balance between less risky index NIFTY 100 and more risky index NIFTY MIDCAP 150 Index. It’s like enjoying best of both worlds

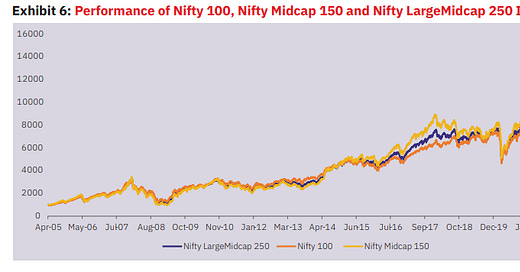

Over the past two years, the Nifty Large Midcap 250 Index has delivered strong returns to investors. In 2021, the index returned 37.96%, outperforming both the Nifty 50 and Nifty 100 indexes, which returned 26.22% and 28.83%, respectively. The Nifty Midcap 150 Index also performed well, returning 37.31% in 2021.

The outperformance of the Nifty Large Midcap 250 Index continued in 2022, as the index returned 28.11%, compared to 20.89% for the Nifty 50 and 23.44% for the Nifty 100. The Nifty Midcap 100 Index also delivered strong returns, returning 25.09% in 2022. This table captures the long term returns profile of the 3 indices and here we can see the exact value proposition of the Large Midcap 250 Index. It gives that extra 1% returns over long term and over 20 years that would mean 1 Lakh investment would yield 16.3L with NIFTY 100 while the large midcap index would have yielded 18.5L = additional 2 Lakhs of returns!

In terms of rolling returns, the Nifty Large Midcap 250 Index has outperformed the Nifty 50 and Nifty 100 indexes over the past five years. For the period from April 2018 to March 2023, the index delivered a five-year rolling return of 18.46%, compared to 16.24% for the Nifty 50 and 16.81% for the Nifty 100. The Nifty Midcap 100 Index delivered a five-year rolling return of 18.07% over the same period.

Overall, the Nifty Large Midcap 250 Index has demonstrated strong performance over the past two years, outperforming its larger-cap counterparts and delivering strong returns to investors. As such, it remains a popular benchmark for investors looking to track the performance of India's large and mid-sized companies.

But What is the best way to invest in the Nifty Large Midcap Index Fund ?

If you check the expense ratios of the NIFTY 100 and NIFTY MIDCAP 150 index funds and compare it with the large midcap index fund then you will find that it’s best to split your investment 50-50 between the 2 index funds with lowest expense ratios. For example : you can just pick SBI ETF Nifty 100 and IDBI Nifty MIDCAP 150 Index Fund and get an expense ratio of 0.2% , whereas the large midcap index funds start at 0.25%. If you don’t mind the 0.05% extra commission to the mutual fund managers , then you can directly explore Edelweiss NIFTY Large Mid Cap 250 Index Fund

1**Clicking on images can get you redirected to Affiliate Links